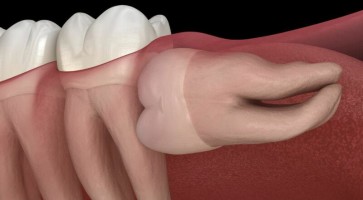

“Chào chuyên gia! Em tên Tài, em đang bị mọc một chiếc răng khôn ở hàm dưới, đỡ một thời gian rồi lại đau kinh khủng không ăn được và...

Niềng răng là phương pháp chỉnh nha phổ biến cho nhiều trường hợp khác nhau. Với nhiều mức giá nhiều lựa chọn, niềng răng phù hợp với nhiều đối tượng...

Cạo vôi răng và tẩy trắng răng là hai phương pháp vệ sinh, làm đẹp cơ bản của nha khoa. Hầu hết tất cả các phòng nha đều có cung...

Một hàm răng ố vàng sẽ khiến vẻ đẹp của bạn bị giảm đi vài phần sức hút. Tuy nhiên, răng ố vàng lại là hiện tượng phổ biến có...

Bên cạnh tẩy trắng răng ngay tại nha khoa, hiện nay không ít người lựa chọn tẩy trắng răng bằng máng tại nhà để chủ động được thời gian và...

Một trong những cách làm trắng răng phổ biến hiện nay là tẩy trắng răng. Trong đó, sử dụng máy tẩy trắng răng White Light ngay tại nhà được khá...